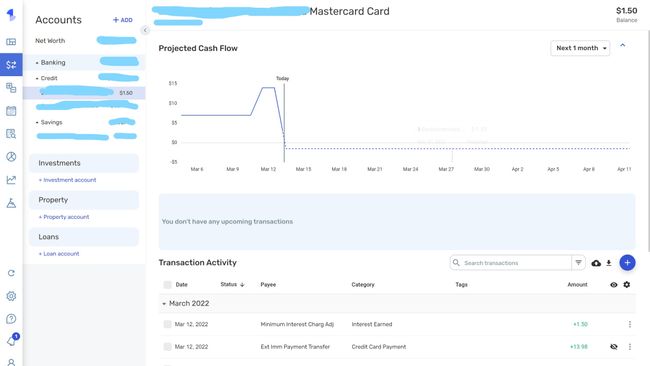

The SaaS offers a personalized budget that is automatically generated based on income, expenses, and savings, and is highly customizable to track progress as users spend. Key notifications, built-in reports, and cash-flow projections make it easy to plan ahead and achieve financial goals. One of Simplifi's key features is its ability to provide timely insights to help users optimize their spending and maximize their savings. The app provides an automatically generated spending plan that is highly customizable to users' needs, helping them stay on budget and manage spending effectively. With the app, users can easily save for multiple goals such as a home, vacation, or emergency fund, while tracking their progress toward short and long-term goals. The webapp's main goal is to help users save more money, plan for the future, and track their spending.

It allows users to manage their finances in one central location, connecting all bank accounts, credit cards, loans, 401(k)s, and investments into a single dashboard. Investment Tracking - It also allows users to track their investments and analyze their portfolio performance.Bill Management - It helps users stay on top of their bills by sending reminders and notifications when bills are due.Goal Setting - Users can set financial goals, such as saving for a down payment on a home or paying off debt, and track their progress towards achieving them.Budgeting - It allows users to create and track budgets based on their spending habits, providing real-time updates on their progress.Expense Tracking - Users can easily track their expenses by linking their bank accounts, credit cards, and other financial accounts.

0 kommentar(er)

0 kommentar(er)